Above: ABA Government Relations Team members (L-R) Chris Fisher, Kirsten Sutton and Ginny O’Neal updated Kansas bankers on KBA’s legislative priorities, giving important advice and talking points for each issue.

Members of the KBA Federal Affairs Committee, KBA Board of Directors and the 2023 KBA BLOK class embarked on a multi-day journey in our nation’s capital to engage with Kansas’ Congressional representatives and federal banking regulators, discussing vital matters concerning the banking industry.

The event kicked off on Sunday evening, September 17, when the BLOK class commenced their visit with an enlightening guided night tour of Washington, D.C.’s iconic memorials and monuments.

Monday morning sessions began with an ABA 101 session hosted at the American Bankers Association’s new office. The day continued with a panel featuring two Chiefs of Staff from Kansas’ Congressional offices.

On Tuesday, the entire delegation reconvened at the ABA office to engage in dialogues with key regulatory bodies, including the FDIC, the OCC and CFPB. The discussions centered around regulatory priorities, covering topics such as DIF modernization, bank capital levels and Section 1071 compliance. In addition, bankers received a comprehensive Farm Bill briefing from ABA staff and gained insights into the FHFA’s System 100 report.

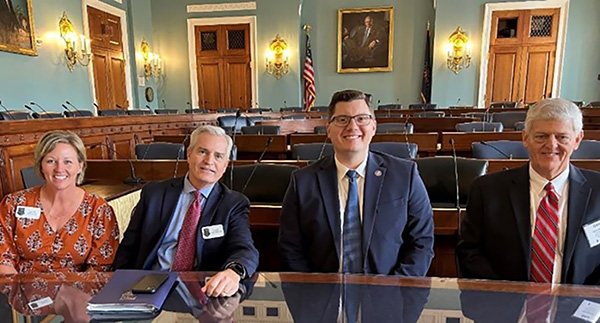

The itinerary continued Wednesday when this group of nearly 60 dedicated bankers visited Capitol Hill. Their discussions spanned a range of critical issues, including the ACRE Act, the Credit Card Competition Act, the potential repeal of Section 1071 Small Business Reporting, and the SAFE Banking Act, among others.

The journey concluded with an evening reception held at the Mayflower Hotel, open to all members of the Kansas Congressional Delegation and their respective staff.