The 2024 CEO & Senior Management Summit/Annual Meeting was held Aug. 8-10 at The Broadmoor in Colorado Springs, Colorado. The event was a definite success! We had an exceptional line-up of presenters, almost 500 attendees and amazing sponsors. Check out some of this year’s highlights.

(Left to right) KBA Past Chairman Mark Schifferdecker, Congressman Tracey Mann, U.S. Sen. Jerry Moran, ABA President & CEO Rob Nichols, and KBA President & CEO Doug Wareham

Mountainside Policy Chat

Kansas bankers had the opportunity to hear predictions on the 2024 federal election season from Sen. Jerry Moran, Congressman Tracey Mann, and ABA President & CEO Rob Nichols during a panel discussion moderated by KBA Past Chairman Mark Schifferdecker and KBA President & CEO Doug Wareham. The panel discussion also focused on priority legislation supported by ABA and KBA, including a proposal to prohibit the use of mortgage trigger leads and ongoing efforts to advance the Access to Credit for Rural Economies (ACRE) Act, which Moran and Mann both support. A common frustration expressed during the panel discussion centered on the tsunami of new bank regulations being promulgated by federal bank regulators.

Dan Meers, KC Wolf

Courageous Leadership — Living a Life of Influence

Dan Meers, also known as KC Wolf, the mascot for the Kansas City Chiefs for the past 30 years, shared his inspirational story of a tragic accident while performing a stunt at Arrowhead Stadium that nearly took his life. Dan spoke about how that accident changed his outlook and how he now lives with passion and purpose, using his platform to help others. He works closely with numerous organizations and ministries that provide aid to orphans and the poor around the world, believing that we are all called to be difference-makers. Dan also discussed his two books, “Wolves Can’t Fly” (2014) and “Mascot on a Mission” (2019), and handed out signed copies to the attendees.

KBA President & CEO Doug Wareham, Former FDIC Vice Chairman/Former Kansas City Federal Reserve President Tom Hoenig, and KBA Past Chairman Mark Schifferdecker

KBA’s Prestigious Flint Factor Award

During his address to CEO Summit attendees, former FDIC Vice Chairman Tom Hoenig highlighted runaway federal spending that has led to federal U.S. debt now exceeding $35 billion. Hoenig indicated federal spending trends, coupled with higher interest rates, could lead to the federal debt ballooning to somewhere between $50 and $60 billion by 2030. While Hoenig is still bullish on the American economy, he said the time for Congress to implement spending restraints and strategies for enhancing federal revenues is upon us.

Following Hoenig’s address, KBA Past Chairman Mark Schifferdecker presented Hoenig with the Flint Factor Award, KBA’s highest award, in recognition of Tom’s leadership and dedication over a 38-year career with the Kansas City Federal Reserve Bank and for his efforts to tailor bank regulation and oversight of community banks during his tenure as FDIC Vice Chairman. Hoenig is currently serving as a Distinguished Senior Fellow at the Mercatus Center at George Mason University. Congratulations, Tom!

Kansas City Federal Reserve’s President & CEO Jeff Schmid and FHLBank Topeka’s President & CEO Jeff Kuzbel

Federal Reserve Update

Jeff Schmid, President of the Federal Reserve Bank of Kansas City, addressed the audience on Thursday afternoon, sharing his insights on current economic conditions and reflecting on his first year in the position after serving more than 40 years in the banking industry, both as an examiner and later as Chairman and CEO of Mutual of Omaha Bank in Nebraska. Schmid discussed the rebalancing of supply and demand, the continued strength of the labor market bolstering aggregate demand, and the persistent challenge of elevated inflation, with housing services playing a significant role. While inflation has eased somewhat over the past year, Schmid noted the uncertainty surrounding future policy rate adjustments needed to achieve the 2% inflation target. President Schmid will become a voting member of the Federal Open Market Committee starting in 2025.

KBA President & CEO Doug Wareham, Former FDIC Vice Chairman/Former Kansas City Federal Reserve President Tom Hoenig, and KBA Past Chairman Mark Schifferdecker

KBA’s Prestigious Flint Factor Award

During his address to CEO Summit attendees, former FDIC Vice Chairman Tom Hoenig highlighted runaway federal spending that has led to federal U.S. debt now exceeding $35 billion. Hoenig indicated federal spending trends, coupled with higher interest rates, could lead to the federal debt ballooning to somewhere between $50 and $60 billion by 2030. While Hoenig is still bullish on the American economy, he said the time for Congress to implement spending restraints and strategies for enhancing federal revenues is upon us.

Following Hoenig’s address, KBA Past Chairman Mark Schifferdecker presented Hoenig with the Flint Factor Award, KBA’s highest award, in recognition of Tom’s leadership and dedication over a 38-year career with the Kansas City Federal Reserve Bank and for his efforts to tailor bank regulation and oversight of community banks during his tenure as FDIC Vice Chairman. Hoenig is currently serving as a Distinguished Senior Fellow at the Mercatus Center at George Mason University. Congratulations, Tom!

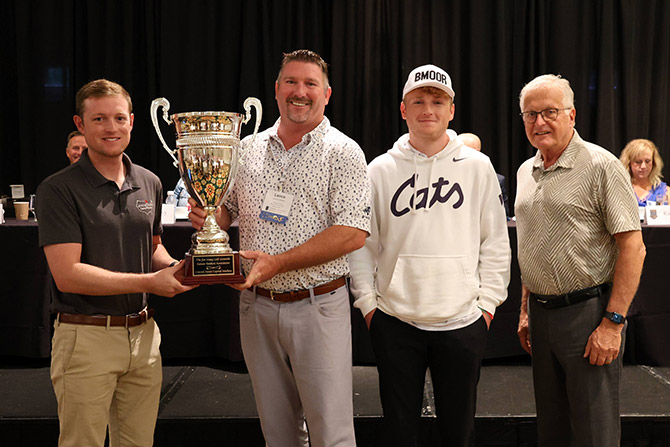

Jim Maag Golf Scramble

The early start of the annual golf scramble allowed a sold-out field of 144 golfers to take advantage of the gorgeous Broadmoor course. This year’s scramble champions, who won the Central States Capital Markets traveling trophy, shot a 56.

It was foggy and chilly at this year’s golf scramble, but the scenery did not disappoint!

Scramble Champions. Central States Capital Markets’ Connor Stepp (left) and Dan Stepp (right) presented the champion’s trophy to Lance White (Bank of the Flint Hills, Wamego) and Talon White. Not pictured are teammates Brandon Lee (Union State Bank, Clay Center) and Justin Sparks (Bankers’ Bank of Kansas, Wichita)

(Left to right) Troy Hutton, FNB Hutchinson, Brad Yaegar, Legacy Bank, Federal Reserve Governor Miki Bowman; Bob Wray, CC Capital Advisors and Troy Soukup, The Citizens State Bank and Trust Co. on hole #18 during the tournament

50-Year Club Award

Frank Carson III, Chairman, Carson Bank

KBA’s President & CEO Doug Wareham presented Frank Carson III with the 50-Year Club Award.

(Left to right) Julie, Cale, Frank III, Kris, Frank IV and Kourtney Carson

The Berkley Family

50-Year Club Award Recipient Bill Berkley, State Bank of Downs, Downs, and KBA President & CEO Doug Wareham

50-Year Club Award Recipient Mark Berkley, The Bank of Tescott, Salina, and KBA President & CEO Doug Wareham

Eight Berkley family members received the Century of Family Banking Awards for their family’s century of ownership of Kansas banks! (Left to right) James Berkley (Solutions North Bank, Stockton), Jeff Berkley (Alliance Bank, Topeka), Burke Matthews (Bennington State Bank, Salina), Mike Berkley (Bennington State Bank, Salina), Lila Berkley, Don Berkley, Bill Berkley (State Bank of Downs, Downs), and Mark Berkley (Bank of Tescott, Salina)

Over 170 Berkley family members were in attendance for the prestigious Century of Family Banking Award ceremony.

Meet your 2024-2025 KBA Officers!

(Left to right) Vice Chairman Kendal Kay, Stockgrowers State Bank in Ashland; Chair-Elect Julie Hower, Farmers & Drovers Bank in Council Grove; Chairman Gene Dikeman, Bank of the Plains in Hutchinson; Past Chairman Mark Schifferdecker, GNBank, N.A. in Girard; and KBA President & CEO Doug Wareham

Federal Reserve Board of Governors Update

Federal Reserve Governor Miki Bowman addressed attendees on Saturday morning, providing an update from the Board of Governors and sharing insights from the July FOMC meeting. She also joined KBA’s EVP and General Counsel Kathy Taylor, in a panel discussion covering increased capital requirements following the 2023 bank failures, the Fed’s decision to lower the debit interchange cap, the trend of credit unions acquiring banks and the impact of higher interest rates on bank earnings.

Governor Bowman highlighted that economic activity continues to expand, though job gains have slowed, and inflation remains somewhat elevated despite recent easing. The FOMC decided to maintain the current federal funds rate, focusing on achieving maximum employment and stable inflation. The Committee does not expect to lower rates until there is confidence that inflation is moving sustainably toward 2%.

Governor Bowman, who holds the Community Bank Seat on the Board of Governors, will serve in this role until January 2034.

Federal Reserve Governor Miki Bowman

The Economy in 2024

The conference concluded with a presentation by Chris Low, Chief Economist for FHN Financial. Chris highlighted that GDP growth (2.0%) has been weaker than in 2023 (3.1%), with domestic demand cooling and high mortgage rates limiting supply, which has kept prices high despite a slump in sales. He also noted that job growth has slowed since March, and average hourly earnings are declining rapidly.

When discussing inflation, Chris pointed out that there has been some progress, with May and June’s CPI readings being the lowest since 2021 and rent inflation showing signs of slowing. He also referenced recent comments from Fed Chair Powell that suggested a possible rate cut in September. Low concluded with market expectations and predictions, indicating that multiple rate cuts could occur over the next few meetings, with the potential for one significant cut, as employment is now the primary reason for reducing rates.

In Attendance

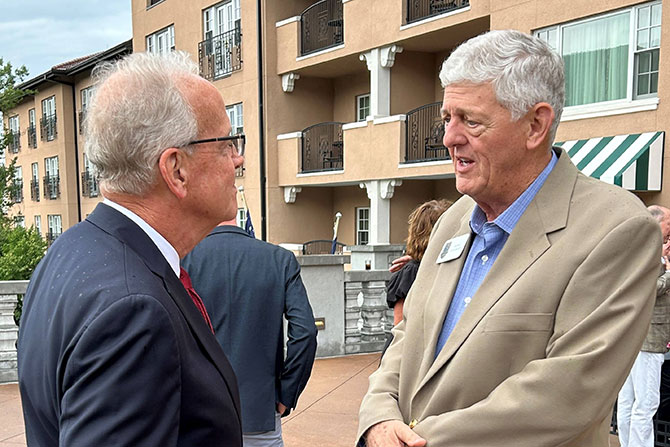

State Bank Commissioner David Herndon and Sen. Jerry Moran

Congressman Tracey Mann and Abby Wendel, Landmark Bank

Jeff Kuzbel, FHLBank Topeka; Doug Wareham, KBA; and Rob Nichols, ABA

KBA officers and leadership with Sen. Jerry Moran, Congressman Mann and Rob Nichols, ABA

Kansas City Federal Reserve’s President & CEO Jeff Schmid and Lance White, Bank of the Flint Hills

J.C. Long, Bank of Commerce & Trust Co., Joe Rottinghaus, Conway Bank and Seth MacKinney, Sen. Jerry Moran’s Office

Rick Sems, Equity Bank, and Congressman Tracey Mann

Gene and Mary Dikeman with Congressman Tracey Mann (middle)

Mike Lyles, Community Bank, and Robert Mendez, BankOnIT

Congressman Tracey Mann and Sean York, ADVANTAGE

Troy Hutton, FNB Hutchinson, and Brad and Janice Yaeger, Legacy Bank

Tom Hoenig and Mark Thompson, Country Club Bank

Charlie and Marla Chandler, INTRUST Bank, and Paul and Mary Thompson, Country Club Bank

Mark Schifferdecker, GNBank; Scott Cooper, Patriots Bank; and Bob Wray, CC Capital Advisors

Outgoing KBA Board Members Craig Heideman, Kaw Valley Bank; Mike Ewy, Solutions North Bank; and Nick Wolfe, United Bank & Trust

Julie and John Hower, Farmers & Drovers Bank

Kyle Campbell, Astra Bank, and Alex Orel, KBA

Janet and Doug Johnson, Guaranty State Bank & Trust, with Sen. Jerry Moran

Jeff and Maribeth Kuzbel, FHLBank Topeka

Monte and W.R. Robbins, Farmers Bank & Trust, and Sen. Jerry Moran

Sen. Jerry Moran, Carol and John Hill, The City State Bank

Sen. Jerry Moran and Gene Dikeman

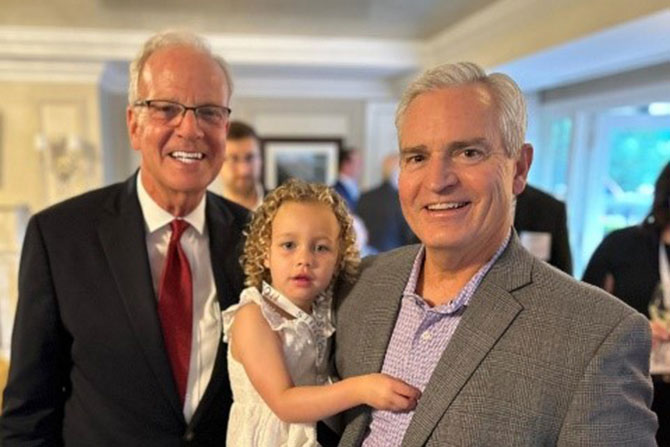

Sen. Jerry Moran, Mark Schifferdecker and granddaughter Norah

KC Wolf Dan Meers at the Spouse and Guest Breakfast

Mavis and Ron Johnson, KBEF Ambassador, and Mark Schifferdecker, GNBank

Spouse and Guest Breakfast program

2024 KBA Annual Meeting

Mark Your Calendars!

Make your plans to attend the 2025 KBA CEO & Senior Management Summit at The Broadmoor on Aug. 7-9, 2025! Please make your room reservations NOW by calling The Broadmoor at (855) 634-7711 and asking for the Kansas Bankers Association room block. If a night is already sold out, please request to be placed on the waitlist! We were sold out by October last year, so don’t delay.

Make your Broadmoor reservations for 2025 TODAY!