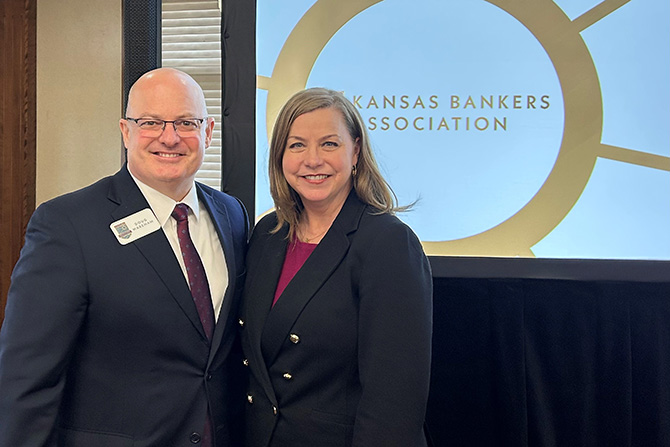

This year’s BLOK Academy welcomed nearly 100 bankers to Topeka Country Club on Feb. 5. KBA President & CEO Doug Wareham kicked off the event with a warm welcome, followed by remarks from Matt Koupal, Executive Vice President and Chief Mission Officer/Chief Legal Officer at FHLBank Topeka (BLOK Class of 2023), who emphasized the significance of this program.

The panel reinforced Koupal’s message on the importance of the BLOK Program and addressed the need for strong advocacy for the financial services industry. Jake LaTurner also provided an insightful perspective on the inner workings of Capitol Hill and his tenure in the Kansas Senate.

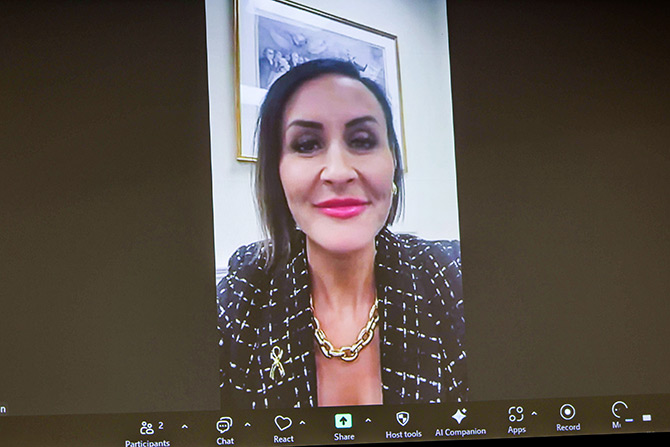

Federal Reserve Governor Miki Bowman (BLOK Class of 2013) joined the BLOK Academy to share insights on her successful career path to the national level. Bowman credited the Bank Leaders of Kansas program for not only important leadership skills, but also for friendships with bankers across the state that will last a lifetime. (Bowman has been nominated by the Trump Administration to serve as the Federal Reserve’s Vice Chair of Supervision and is currently awaiting confirmation.)

Bowman, in her afternoon update, also addressed the Government Relations Conference attendees and emphasized the importance of tailoring regulations, advocated for a problem-focused approach to bank supervision, and stressed the need for innovation in the banking system. She shared her vision for a balanced regulatory framework that promotes safety and soundness while enabling economic growth and technological advancement in the financial sector.

2024 BLOK Class

- Stephen Austin, Bank7, Montezuma

- Ali Aylward, Bank of Commerce, Chanute

- Shannon Beal, Citizens Bank of Kansas, El Dorado

- Brian Berkley, Solutions North Bank, Stockton

- Michael Carlson, Denison State Bank, Holton

- Kerry Clark, Kansas Bankers Association, Topeka

- Alison Clutter, Bankers’ Bank of Kansas, Wichita

- Loren Erway, Farmers Bank & Trust, Atwood

- Jenny Figge, Kansas Bankers Association, Topeka

- Ryan Fleck, Legacy Bank, Wichita

- Mark Galloway, Bank of Tescott, Salina

- Kate Haverkamp, First Heritage Bank, Centralia

- Jenell B. Hulse, Bank of the Plains, Salina

- Jessica Kerr, Golden Belt Bank, Hays

- Cher McLachlan, First National Bank of Hutchinson, Hutchinson

- Taylor Sharp, TriCentury Bank, De Soto

- Billy Skrobacz Jr., Capitol Federal Savings Bank, Topeka

- Andy Stegman, GNBank, N.A., Offerle

- Taylor Stos, Community National Bank, Topeka

- Lance Tilton, Astra Bank, Chapman

- George von Leonrod, First National Bank, Dighton

- Andy Watkins, INTRUST Bank, N.A., Wichita

- Gant Welborn, FHLBank Topeka, Topeka

- Candace Wolke, Vintage Bank Kansas, Conway Springs

2025 BLOK Class

- Neal Barclay, Kansas Bankers Association, Topeka

- Matyson Barnes, Farmers Bank & Trust, Overland Park

- Dan Duchnowski, Equity Bank, Wichita

- Chris Endicott, FHLBank Topeka, Topeka

- Jared Engelbert, The First State Bank, Norton

- Brandon Grigsby, Stockgrowers State Bank, Ashland

- Daniel Hayden, Bankers’ Bank of Kansas, Wichita

- Cody Heiman, First Bank Kansas, Salina

- Gwen Hill, Kansas Bankers Association, Topeka

- Chrissy Lewman, The Union State Bank of Everest, Atchison

- Beth Masterson, Legacy Bank, Wichita

- Paige Meader, First National Bank of Kansas, Waverly

- Joel Milford, First National Bank of Hutchinson, Hutchinson

- Mazie Mobley, INTRUST Bank, N.A., Wichita

- Trenton Moore, Equity Bank, Neodesha

- Kim Parks, ESB Financial, Emporia

- Susan Rash, Community National Bank, Seneca

- Tyson Reimer, Central National Bank, Junction City

- Sarah Sanders, Capitol Federal Savings Bank, Topeka

- Kaycie Schilling, FNB Bank, Goodland

- Thomas Sheik, State Bank of Bern, Bern

- Derek Stephens, First Interstate Bank, Shawnee

- Bryan VonFeldt, Astra Bank, Hays

- Brandi Zimmer, Guaranty State Bank & Trust Co., Beloit

Welcome, 2025 BLOK Class, your journey has just begun!

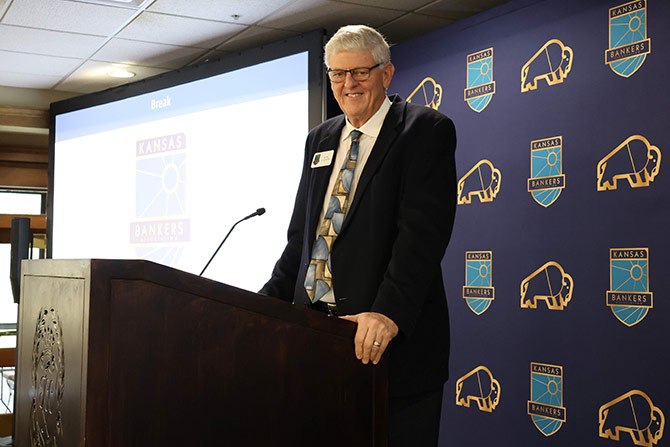

Following the BLOK Academy, the event transitioned into the Government Relations Conference, where over 200 bankers gathered to continue discussions on industry advocacy and policy. The conference started with a welcome from KBA Board Chairman Gene Dikeman, Bank of the Plains, Hutchinson. Chairman Dikeman thanked everyone for coming together to deliver a collective message to state lawmakers, elected officials and several staff members from our Kansas Congressional Delegation on behalf of Kansas banks and their communities and customers.

Legislative leaders discussed state issues impacting the Kansas economy and the banking industry. They covered various topics, including property taxes, water, state agency budgets, the Committee on Government Efficiency and the possibility of the Kansas City Chiefs relocating to Kansas.

The Federal Issues Update covered topics including strategies for passing ACRE, bank regulatory asset threshold caps, and Senate Banking Chairman Tim Scott’s priorities. The group also discussed pressing issues such as mortgage trigger restrictions, the Congressional Review Act’s potential use, and new bank formation efforts.

KBA SVP of Government Relations Alex Orel and VP of Government Relations & Staff Attorney Kelly VanZwoll provided a legislative update. Orel discussed efforts to modernize public funds statutes, housing, property taxes and water resources. VanZwoll covered state-level interchange proposals, banking code updates and OSBC modernization. She also addressed ESG legislation and the KBA’s efforts to counter harmful proposals.

That evening, legislators were invited to attend a special reception offering bankers a valuable opportunity to connect with their state government officials, exchange insights and discuss issues relevant to the financial industry. The event aimed to strengthen relationships and encourage meaningful conversations between policymakers and members of the banking community.