Above (L-R) Back Row: Nick Barnes, Kendal Kay, Mark Schifferdecker, Dan Bolen, Gene Dikeman, Tony Nemec, Kathy Taylor. Front Row: Doug Wareham, Janelle Wareham, Nancy Schifferdecker, Michelle Bowman, Kyle Campbell, John Hower, Kendra Campbell, Julie Hower, Mary Dikeman, Matyson Barnes

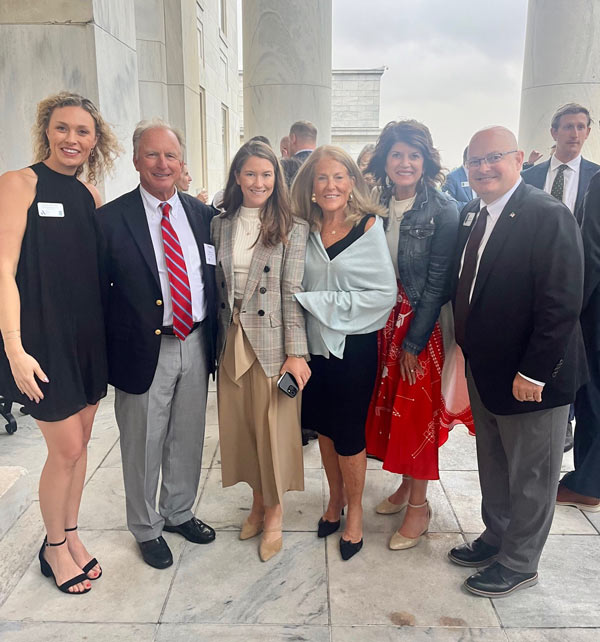

On Thursday, Sept. 18, Kansas native Michelle “Miki” Bowman was sworn in as the Vice Chair for Supervision for the Board of Governors of the Federal Reserve System. Kansas Bankers Association Leadership was honored to participate in the official swearing-in ceremony in Washington, D.C.

KBA Board of Directors, members of the KBA Federal Affairs Committee and the 2025 KBA Bank Leaders of Kansas (BLOK) spent several days in the nation’s capital to lobby Kansas’ members of Congress and to visit with Federal banking regulators about issues of importance to the banking industry.

The BLOK class started their visit with a guided night bus tour of Washington, D.C.’s memorials and monuments on Sunday evening, Sept. 14. Morning sessions began on Monday, Sept. 15, with an ABA 101 at the American Bankers Association’s office and a panel discussion with Kansas’ Congressional Staffers to gain an insider’s view of Congressional operations.

On Tuesday, Sept. 16, the entire group resumed meetings at the ABA office, having a dialogue with the U.S. Department of the Treasury, the FDIC and the OCC, presenting KBA’s regulatory priorities including indexing regulatory bank thresholds, modernizing FDIC deposit insurance, the potential repeal/rewrite of Section 1071, guidance on the debanking executive order, and obtaining official guidance on the ACRE Act contained in the One Big Beautiful Bill (OBBB). Bankers also heard from ABA staff on the potential of a “Farm Bill 2.0” to address ag issues that weren’t included in the OBBB.

On Wednesday, Sept. 17, the group of almost 60 bankers visited Capitol Hill to thank lawmakers for their support of the ACRE Act and the bill prohibiting mortgage trigger leads. Bankers also shared KBA’s legislative priorities, which include indexing regulatory and statutory asset thresholds, modernizing FDIC deposit insurance, credit union taxation and the potential for a Farm Bill 2.0, among other issues. The trip concluded with an evening reception open to all Kansas Congressional Delegation members and their staff, which took place on the Hill in the U.S. Capitol House Agricultural Committee Room. Please see the highlights from the trip in the following:

Kansas Bankers Meeting With Their Kansas Congressional Delegation

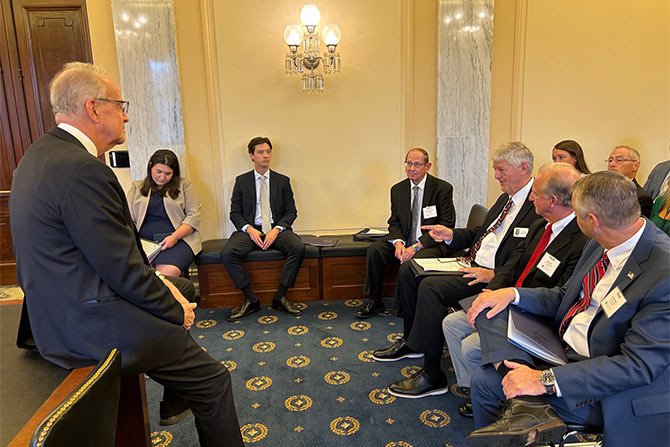

U.S. Department of the Treasury Discussion

KBA met with John Crews, Deputy Assistant Secretary for Financial Institutions with Treasury, to discuss future guidance on the ACRE Act tax deduction, specifically to explain why clarity on the “refinancing” piece is needed. They also discussed the debanking executive order from President Trump, the status of stablecoins/CBDC, and indexing regulatory thresholds such as CTR requirements.

KBA Briefing at American Bankers Association’s Headquarters

FDIC Discussion

KBA met with Ryan Billingsley, Director, Division of Risk Management Supervision and Alex LePore, Deputy Advisor to Acting Chairman Hill, at the FDIC headquarters to present the KBA’s stance on FDIC deposit insurance reform and the need for universal coverage. Bankers also discussed the FDIC’s proposal on indexing regulatory thresholds and regulatory guidance on President Trump’s debanking executive order.

OCC Discussion

Greg Coleman, OCC Senior Deputy Comptroller for Bank Supervision and Examination and staff members met with the KBA at their headquarters. Bankers thanked them for their quick actions to eliminate reputational risk and regulatory guidance on responding to President Trump’s debanking executive order. Bankers also stressed the need for regulatory index tailoring and the OCC’s continued defense of preemption in the banking space.

Congressional Staffer Panel Discussion

The 2025 BLOK Class was joined by U.S. Senator Moran’s Financial Services Legislative Assistant, Seth MacKinney, and Congressman Derek Schmidt’s Chief of Staff, Krisann Pearce, for a behind-the-scenes look at a day in the life of a staff leader on Capitol Hill. The panel was kicked off by Ryan Gilliland, First Vice President, Director of Government and Industry Relations for FHLBank Topeka. KBA President & CEO Doug Wareham then moderated the conversation, which discussed best practices for industry engagement with elected officials, staff challenges in balancing campaign and official duties, and Congress’s priorities for the year. Special thanks to FHLBank of Topeka for sponsoring this session and the BLOK program.

KBA Reception at U.S. Capitol House Agriculture Committee Room

KBA Board and Federal Affairs Committee Members Leading the Charge in Washington, D.C.