KBA started the Bank Leaders of Kansas (BLOK) program in 2006 with a vision of developing Kansas bankers and exposing them to a wide range of topics that influence the industry while building a collaborative networking community. The 17th BLOK class convened for their first session in Topeka at the KBA Office on Feb. 7, 2023.

This year’s class is comprised of:

Amy Barber

Trust Fiduciary & Compliance Manager

Central National Bank, Topeka

Crystal Boyer

Treasury Banking Analyst

First Interstate Bank, Shawnee

Kelsey Burdiek

Assistant Vice President

United Bank & Trust, Seneca

Jen Cocking

Vice President, Assistant General Counsel

Capitol Federal Savings Bank, Topeka

Dena Flach

Vice President/Loan Officer

Stockgrowers State Bank, Maple Hill

Alex Goodpaster

Vice President, Commercial Lending

Equity Bank, Overland Park

Mike Hamilton

EVP — Ag Banking

Adams Bank & Trust, Colby

Victoria Hamilton

Officer & Financial Center Manager

First National Bank of Hutchinson, Hutchinson

Kristie Henry

Controller

Community National Bank, Seneca

Dustin Hickel

Managing Director — Commercial Real Estate Lending

INTRUST Bank, N.A., Prairie Village

Brett Hubka

Community Bank President

GNBank, N.A., Clay Center

Sarah Keeny Moon

Accounting Analyst

Citizens Bank of Kansas, Derby

Carl Keith

Regional President

Solutions North Bank, Hill City

Garet King

Vice President

Fusion Bank, Overland Park

Matt Koupal

SVP, Chief Legal and Ethics Officer,

Corporate Secretary

FHLBank Topeka, Topeka

James Leftwich

Sales Representative

Security 1st Title, LLC, Wichita

Katrina Loader

SVP Chief Retail Officer & BSA Officer

Astra Bank, Abilene

Rex Reynolds

Executive Vice President

Legacy Bank, Wichita

Elizabeth Roche

SVP — Employee Benefits

Kansas Bankers Association, Topeka

Justin Sparks

EVP — Chief Credit Officer

Bankers’ Bank of Kansas, Wichita

Adeel Syed

VP — Staff Attorney

Kansas Bankers Association, Topeka

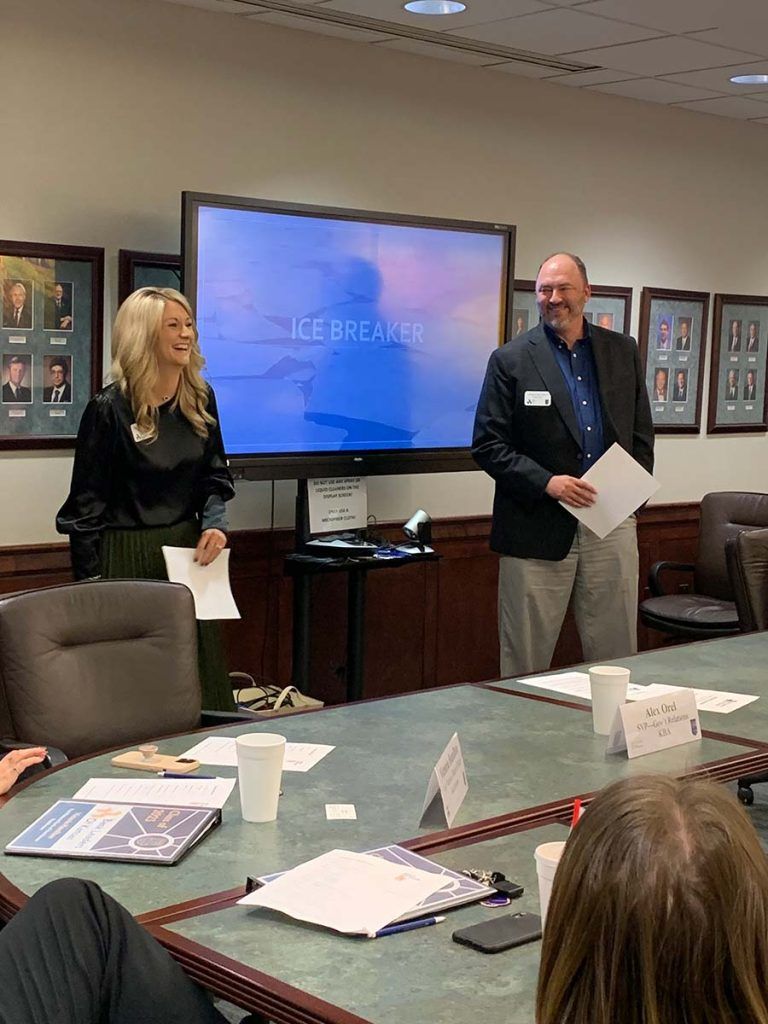

After an overview of the program by KBA’s SVP — Government Relations Alex Orel, the class got to know each other during an ice-breaker exercise where many laughs and personal stories were shared. Next, a complete summary of the history, structure, and governance of the KBA was outlined followed by staff spotlights, allowing senior management to share their roles and areas of expertise and how each department at the KBA can assist them and their banks. The BLOK class then enjoyed dinner and more time to get acquainted with the KBA staff.

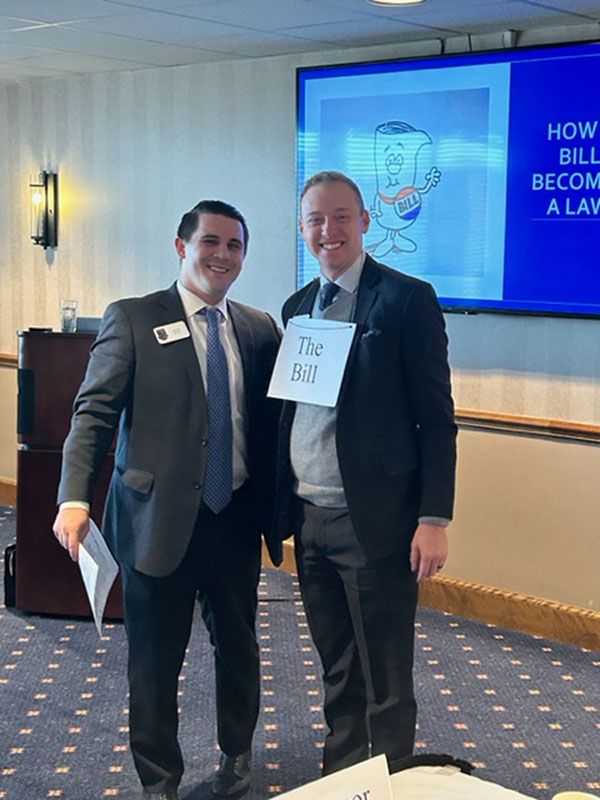

Day two focused on state advocacy and began with an interactive presentation on the legislative process led by Orel and KBA AVP — Government Relations Kelly VanZwoll. The BLOK class then participated in the KBA Harold A. Stones Government Relations Conference, followed by a legislative reception at the Topeka Country Club.

The third day of Session 1 started with the class networking with KBA Board members and sitting in on the first hour of the board meeting. The class then transitioned to downtown Topeka to hear from Deputy Bank Commissioner Tim Kemp about the role of the Office of the State Bank Commissioner as our state financial institutions regulator. The class was then treated to a legislative panel in a Statehouse committee room. The panel featured Senate Financial Institutions and Insurance Committee Chair Sen. Jeff Longbine; House Appropriations Chair Rep. Troy Waymaster; House Financial Institutions & Pensions Committee Chair Rep. Nick Hoheisel; and House Financial Institutions & Pensions Committee Member Rep. Rebecca Schmoe. Following the legislative panel, the group received a behind-the-scenes tour of the Capitol building, including a tour of the House chamber by Speaker of the House Dan Hawkins. During the visit to the Senate chamber, Senator Longbine recognized the class during the Senate’s general session.

The 2023 BLOK Class will have their second session in Kansas City on May 24–26.

2023 BLOK Sponsors

- INTRUST Bank, N.A.

- FHLBank Topeka

- KBA Insurance, Inc.

- Professional Bank Consultants, LLC

- Bankers’ Bank of Kansas