In Kansas, where golden fields stretch across the horizon and agriculture is a cornerstone of life, community agriculture bankers play an essential role in supporting local farmers and agribusinesses. These professionals combine financial expertise with a deep understanding of the state’s agricultural landscape, offering tailored financial solutions and personalized advice. Their efforts help farmers invest in new technologies, diversify crops and enhance practices, driving growth and stability in the sector. By fostering relationships and promoting sustainable methods, community agriculture bankers ensure the preservation of Kansas’ natural resources for future generations. Their dedication is vital for maintaining the vibrancy and resilience of Kansas’ rural communities.

David White

Sr. Commercial Relationship Manager – Commodities & Correspondent Banking

INTRUST Bank, Wichita

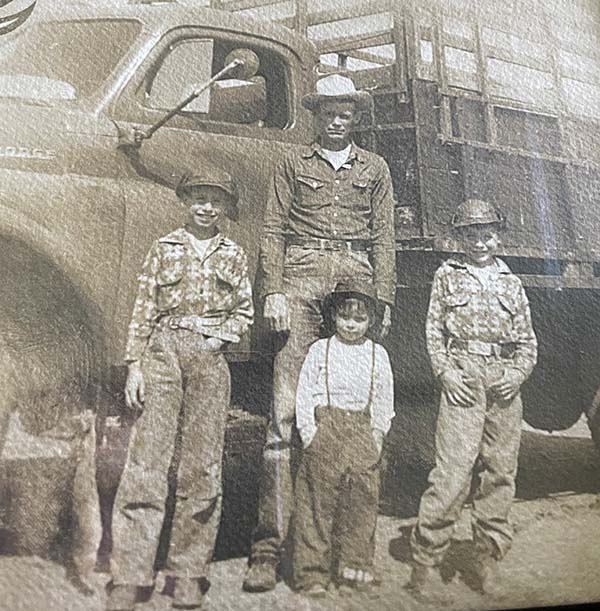

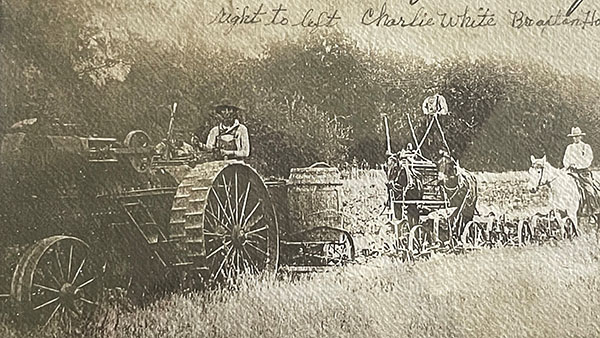

David White, a fourth-generation farmer and banker, grew up on his family’s farm in Wellington. With nearly 2,000 acres dedicated to growing wheat, beans, corn and milo, his extensive hands-on experience in farm operations demonstrates his practical knowledge and reliability in the field. David’s great-grandfather, Charlie, originally from Illinois, moved to Kansas after a dispute with his brothers. He began working for a local farmer, which set the foundation for the family’s farming legacy.

David graduated from Wellington High School in 2006, where he was actively involved in 4-H and Future Farmers of America. He then pursued a degree in agricultural economics at Kansas State University. During an internship with Farm Credit, David’s interest in the banking industry was sparked as he saw how his classroom knowledge could be applied practically to assist farmers. After graduating from K-State in 2010, he furthered his education by earning an MBA with a concentration in finance from Fort Hays State University in 2014.

“From an ag banking standpoint, I have the opportunity to help producers like my family be successful and have the tools they need to grow and stay relevant,” David said, “and inspires me to be involved in the industry.”

After working at Farm Credit, David started his career at INTRUST Bank, N.A., in Wichita and has been with them for 11 years. INTRUST offers a full suite of financial products for its ag clients, including lines of credit, term loans for equipment and real estate purchases. David and his team pride themselves on digging in and understanding their client’s businesses and tearing their lending solutions to fit their individual needs. They also offer robust deposit and treasury management products, including vital digital online banking tools to help clients manage their cash flow. Across the street from their headquarters, they have a dedicated investment team that can help manage personal wealth investments, 401K plans for some of their more extensive operations with a larger employee base, and other retirement plans. If there is a financial need, they have a product for it.

Throughout his banking career, David has actively participated in the Kansas Ag Bankers (KAB) board and is a 2015 graduate of the Bank Leaders of Kansas (BLOK) program of the KBA. After eight years of service on the KAB board, including terms as president in 2022 and past president in 2023, he has started a new role on the American Bankers Association Ag Bankers Committee where he will assume the position of vice chair at the upcoming convention in November. Among his responsibilities, he leads the conference planning committee for the 2025 ABA National Ag Banking Conference.

Robert Rugan

Central Kansas Market President

Farmers Bank & Trust, Great Bend

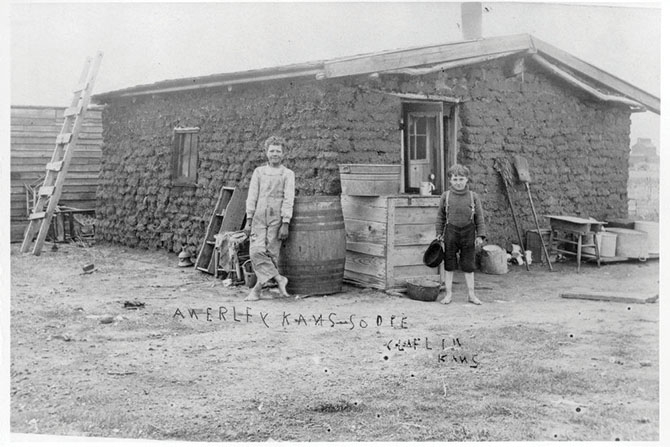

Robert Rugan, a banking professional with a unique background, is a fifth-generation farmer and banker. Hailing from Claflin, Kansas, he was raised on his family farm, which was homesteaded by his great-great-grandparents in the 1870s. His family’s migration from Germany to the area, driven by the Homestead Act, established a well-diversified, irrigated and dry-land farm with a cattle operation, growing alfalfa, soybeans, corn, wheat and sorghum.

Robert completed his high school education at Claflin High School in 1986. His upbringing on the farm and active participation in Future Farmers of America have significantly shaped his interest in ag banking due to the leadership development opportunities, record keeping and business acumen it requires.

After graduating from high school, Robert attended Barton County Community College and graduated in 1988. He then received his bachelor’s degree in finance and an MBA from Wichita State University in 1990 and 1991. Robert met the love of his life, Cheryl, at Barton County Community College, and they got married after college.

His first job out of college was as an officer trainee at Bank IV, which is now Bank of America, where he was involved in the trust department in employment benefit plans and then took over management for the McPherson branch. He wanted to return to the farm, so he eventually left banking in 1996 and returned to his family farm for the next 11 years.

During this period, while farming, he served on the board of First Kansas Bank, which needed an agricultural lender. Seizing the opportunity, he returned to banking in 2007. He then joined American State Bank in Great Bend as an agricultural lender. In 2014, he accepted another opportunity, becoming the Central Kansas market president at Farmers Bank & Trust, alongside W.R. Robbins, to manage their western market banks.

Throughout his banking career, Robert attended and graduated from the Graduate School of Banking in Colorado in 2016. He also completed the Ag Lending and Advanced Ag Lending School program through the Schools of Banking. Robert has also served on the Kansas Ag Bankers (KAB) board for 5 years.

Farmers Bank & Trust offers a complete line of ag products, including lines of credit like equipment and land loans, letters of credit and various other needs. They assess potential ag customers or businesses based on tax returns, cash flow analysis and debt service capacity.

“I believe one of the best tools that we utilize with our ag customers to maintain good financial health and sustainability is debt service capacity,” Robert continued, “developing an understanding of how much debt they can handle.”

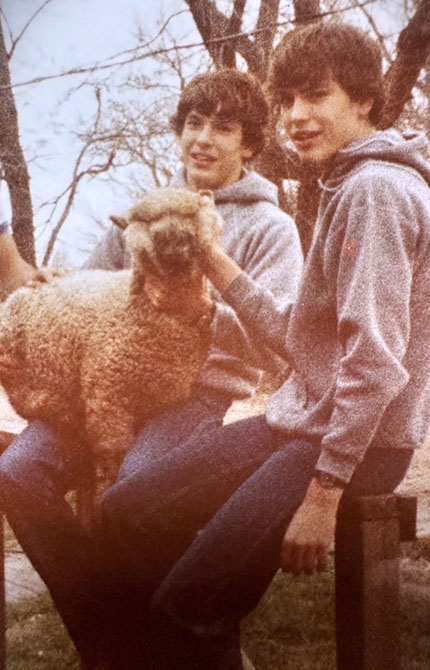

Over the years, Robert fondly recalls three young men who returned to their community after college to pursue farming, and he was able to assist them in getting started. One started on his own with a family acquaintance, and the other two began to take over and expand on the farms from their own family.

“Working with those three young men in their separate operations and watching them grow in our community has been a real success story for me,” Robert said. “They have been with me since 2007 when I started on the ag banking side, and I’ve watched their farms grow and expand. They are doing very well.”

Getting to know people and making personal connections was one of the most essential factors in Robert’s career. A role model that Robert looked up to is Roger Murphy, a peer in banking and feedlot owner who has been incredibly influential in helping grow his family farm.

When Robert isn’t banking, he and his wife, Cheryl, enjoy going to the lake and spending time with their kids, Wyatt, a senior accountant for the town of Vail in Colorado, and Olivia, a senior in accounting at the University of Kansas.

Shelly Turner

Vice President and Trust Officer

Security State Bank, Scott City

Shelly Turner was born and raised on her family farm in Scott City, where she continues the family legacy as a fourth-generation farmer. Growing up, she assisted her parents with cattle work, operated the tractor, moved pipes, handled irrigation and performed many other tasks on the farm. During high school, Shelly was active in volleyball, basketball and track, graduating from Scott City High School in 1993.

Shelly’s thirst for knowledge and intellectual curiosity led her to pursue higher education after high school. Her academic journey is a testament to her skill, earning several degrees: an associate degree from Garden City Community College, a bachelor’s degree from Newman University in Wichita, a master’s degree from Fort Hays State University, and a doctorate from Southwestern College in Winfield. She began her professional career in education, serving as a teacher and then as a high school principal for 19 years at Scott City High School.

By 2015, Shelly felt burned out in education and ready for a change. She transitioned to a new career in the banking industry, joining Security State Bank in Scott City as a loan officer. Shelly credits her hiring to her extensive agricultural experience; she and her husband, Brett, manage a cow-calf operation and farm approximately 10,000 acres. The bank’s president reached out to her because they had been banking with Security State Bank as agricultural customers since around 2005, and they had been farming together for over 20 years.

This is what a typical day on the farm looks like for Shelly: checking in on her cattle with her husband, harvesting the field, meeting with ag customers and branding her cattle.

“Banking and agriculture have been a great career change for me,” Shelly said. “There is never a morning when I don’t love to get up and go to work. I can work at the bank in the morning and work in the field after lunch, and we make it work on our farm. It’s a great mix.”

Shelly’s role at Security State Bank is a testament to her versatility and adaptability. While her focus has shifted from education to banking, she still maintains a solid connection to the agricultural community, lending to ag and commercial customers. In addition, she handles compliance and cash management, showcasing her financial acumen and attention to detail. As the head of the trust department, she manages a diverse range of financial services, a role she has embraced since joining the small rural community bank 9 years ago.

“For me, banking and agriculture go hand in hand,” Shelly said. “Women in agriculture and banking are not the norm and are ever-changing right now. It seems like there are more and more women in agriculture and banking now, but 20 years ago, it didn’t exist.”

Even when Shelly became a high school principal, it was almost unheard of for a woman to hold that position, as most principals were men. She has always been an outgoing and outspoken woman, and she is very confident in what she does for the bank and her customers.

“I have a good background with what I have done in education and what I have done on my own farm,” Shelly said. “I always can make connections and relationships with all my customers.”

Shelly encourages young people, especially girls interested in agricultural lending or a banking career, to gain experience by engaging with farmers and conversing with bankers. These personal interactions and insights into the agricultural sector from a farmer’s perspective provide a valuable foundation.

Turner and her team offer various agricultural products, including ag real estate, lines of credit, ag machinery and equipment, and cattle loans. Evaluating the creditworthiness of a farming operation or ag business involves a meticulous review of the customer’s financial statements, tax returns, profit and loss records, cash flows, and whether the customer has consolidated all their financial accounts with the bank.

Shelly has served on the Kansas Ag Bankers Division (KAB) board for five years and the Kansas Future Farmers of America Board of Trustees for one year.

When Shelly isn’t working at the bank or on the farm, she enjoys spending time with her four dogs: German Shorthaired Pointers Abby and Rosie, a German Shepherd named Jewels and a Boxer named Ziggy.

Credit: Kansas State Historical Society. Copy and reuse restrictions apply.