The adoption of the One Big Beautiful Bill (OBBB) by Congress, which was subsequently signed into law by President Trump, cemented two significant tax policies strongly supported by the Kansas Bankers Association into federal law. Despite a myriad of political naysayers who believed the budget/tax reconciliation debate would roll into the second half of 2025, the razor-thin Republican majorities in the U.S. Senate and U.S. House of Representatives delivered their finished product to President Trump’s desk before their self-imposed Independence Day deadline.

Our KBA-supported top priorities included:

- Maintaining the current Section 199A deduction rate of 20% for Subchapter (Sub) S banks and making the deduction permanent. Failure to extend the 20% deduction rate for Sub S banks would have created chaos for a strong majority of Kansas banks. KBA welcomes and applauds the permanent tax treatment of Sub S banks across America.

- Adopting the KBA-supported and Kansas Banker-inspired Access to Credit for our Rural Economies (ACRE) Act provision will provide banks with a permanent 25% deduction for interest income derived from qualified agricultural real estate loans. The adoption of a permanent ag real estate tax deduction in the OBBB is the culmination of years of advocacy, education and outreach by the KBA and hundreds of Kansas bankers who spearheaded this effort.

Adopting the ACRE Act now triggers an implementation process that will ultimately involve the Internal Revenue Service (IRS), which will need to draft guidance for the policy. KBA will remain fully engaged as we enter the implementation phase for the ACRE Act, and we are already communicating regularly with ABA staff and expert tax practitioners to develop and provide guidance to Kansas bankers as quickly as possible.

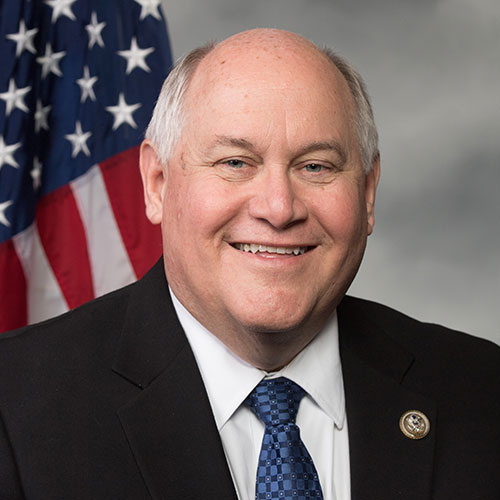

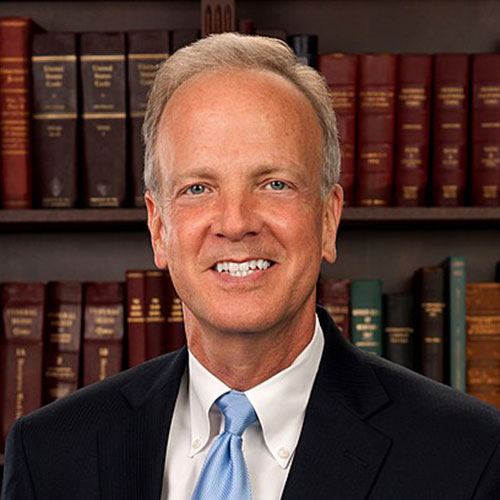

I would be remiss if I did not express gratitude on behalf of the Kansas banking industry for the leadership provided by our Kansas Congressional Delegation that led to the adoption of this important tax policy provision. U.S. Senator Moran has authored and championed this proposal for two decades and was instrumental in securing support from leadership in the U.S. Senate. Kansas 4th District Congressman Ron Estes, who serves on the powerful U.S. House Ways and Means (Tax Policy) Committee, was also instrumental in securing an ACRE Act provision in the original budget/tax reconciliation package adopted by the U.S. House.

U.S. Senator Roger Marshall, Congressman Tracey Mann and Congressman Derek Schmidt were also co-sponsors of the ACRE Act and actively advocated for passage of this measure with their Congressional colleagues. We thank each of these leaders for advancing a policy that will help sustain banks across Kansas by allowing them to better serve their farm and ranch customers with lower-cost agricultural credit. With many agricultural producers facing financial pressure created by low grain commodity prices and record-high crop input prices, this policy change will prove to be an immediate beneficial tool for bankers and their ag borrowers. And finally, thank you, Kansas bankers … mission accomplished!

“The ACRE Act provision Republicans included in the One Big Beautiful Bill will enhance the ability of community banks to support ag producers facing low grain commodity prices and record-high crop production costs,” said Representative Ron Estes. “ACRE provides farm bank lenders a tool they can immediately use to lower interest rates for agricultural borrowers. This policy is good for farmers, ranchers and rural communities across Kansas.”

“For years, rising inflation and high interest rates have imposed economic strain on farmers in Kansas and across the country,” said Senator Moran. “I’m pleased that the ACRE Act has been signed into law to provide lower interest rates for Kansas farmers and ranchers struggling with low commodity prices. This legislation will help sustain the presence of rural community banks by making them more competitive and better able to meet the financing needs of their customers.”