Many banks across the country are at risk of CAMELS downgrades, increased deposit insurance assessment premiums, and regulatory enforcement actions due to inadequate risk management practices for their COVID-19 Loan Modification Program.

Loan modifications have been part of most banks’ lending operations for many years. Before the coronavirus, such modifications were often prompted by a borrower’s “financial distress.” Banks would attempt to work with the financially distressed borrower by granting a “concession” that the bank otherwise would not consider other borrowers with a similar risk profile. An example of such a loan modification might be an interest rate reduction. Generally speaking, this type of loan modification would be categorized as a Troubled Debt Restructure (“TDR”) under accounting literature (ASC 310-40) and reported as such in Call Reports.

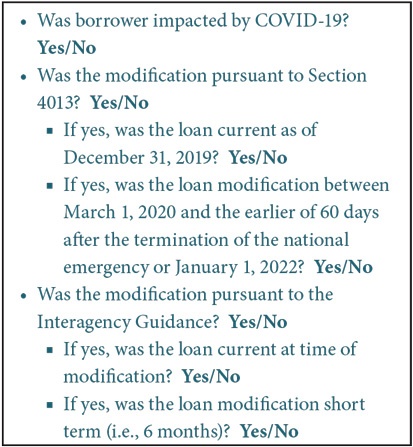

When the country became engulfed with the coronavirus, both Congress (Section 4013 of the CARES Act, extended by Section 541 of the Consolidated Appropriations Act 2021) and the Regulators (April 2020 Interagency Guidance) issued information to guide banks on TDR designations for COVID-19 related loan modifications. It is critical for bankers to understand that while Section 4013 and the April 2020 Interagency Guidance both discuss the applicability of TDRs, they have materially different requirements (modification duration, date of record for current/delinquency status, etc.) for determining when the TDR designation is necessary. FinPro urges all banks to specifically designate whether the COVID-19 Loan Modification was approved under Section 4013 of the CARES ACT or under the April 2020 Interagency Guidance. This documentation should be in each loan modification file and address the following items:

Also, remember that banks must maintain records on the number and dollar amount of loan modifications approved under Section 4013 and under the Interagency Guidance and report this data to the board of directors on a regular basis.

Over the course of the last year, bank regulators have issued several additional Interagency documents that include guidelines on Loan Modifications. These documents have encouraged banks to work with borrowers who have been negatively impacted by COVID-19. However, these guidelines also consistently reference “prudent” efforts to work with borrowers and modify loan terms and further state that examiners will not criticize “prudent” efforts to modify terms on existing loans. The basic focus of “prudent” efforts to modify loan terms implies that the bank is acting to enhance the collectability of modified loans and is doing what is in the bank’s best interests and not just what is in the borrower’s best interests, although hopefully in most cases these interests will be the same.

And while there have been changes in the requirements for designating modified loans as “TDRs,” other important considerations have not changed.

Banks must properly “Risk Rate” COVID-19 loan modifications and incorporate such risk ratings into their ALLL/ACL calculations. Loans modified under Section 4013 or the Interagency Guidance pertain ONLY to borrowers who have been impacted by the coronavirus. By definition, these borrowers have financial performance less robust than before COVID-19. In some cases, these borrowers may have serious cash flow problems driven by the coronavirus that impact their ability to service their debt. It is incumbent on banks to accurately “Risk Rate” these borrowers at the time of loan modification and on a regular basis going forward. FinPro has observed that some banks have internally “risk rated” their COVID-19 loan modifications to a “watch” category where more severe risk ratings may be warranted. In May 2020, the regulators issued “Interagency Guidance on Credit Risk Review Systems” which every bank should be familiar with. The argument that banks and examiners should not adversely classify loans because the borrower has been negatively impacted by COVID-19 will not prevail.

As stated earlier, these new risk ratings must be incorporated into the ALLL/ACL calculations. One “best practice” observed for community banks across the country is to establish a “homogenous pool sub-tier” within the ALLL/ACL methodology to break out all such loan modifications within each homogenous pool. Noteworthy, this approach is often used in conjunction with a new “COVID-19 Q-Factor” that many banks now incorporate into their ALLL/ACL methodology. Some banks have actually appended a one- or two-digit code to COVID-19 loan modifications to ensure easy identification over time.

Rarely, if ever, have regulators criticized a bank for aggressively placing loans on nonaccrual or adversely classifying them.

The rules for placing credits on nonaccrual have not changed. For regulatory reporting purposes, an asset is to be reported as being in nonaccrual status if: (1) it is maintained on a cash basis because of deterioration in the financial condition of the borrower, (2) payment in full of principal or interest is not expected, or (3) principal or interest has been in default for a period of 90 days or more unless the asset is both well secured and in the process of collection. Further details can be found in the Call Report instructions.

Corporate Governance is critical to avoid CAMELS downgrades and enforcement actions. Corporate Governance starts with a comprehensive documentation process. As noted earlier, banks must maintain records of all COVID-19 loan modifications, specifically noting whether such modifications were executed under Section 4013 of the CARES Act or the Interagency Guidance. Remember, modifications cannot fall under both categories since they have different (and competing) requirements. This information should be reported to the board of directors on a regular basis. Similarly, management must inform the Board of Risk Rating trends for COVID-19 loan modifications and how such ratings have impacted the Bank’s ALLL/ACL. In cases where a bank has a significant volume of modified loans, stress testing of these loans as well as other loans in the bank’s portfolio is a critical element in evaluating risk. And perhaps most importantly, the bank needs to have loan workout officers with the skill sets required to deal with troubled credits. While this may result in increased expenses, the benefits of having the right staff in place will most likely result in less expense than the losses which could result from missteps in collecting problem credits. These actions, together with updated policies and procedures to incorporate coronavirus actions, robust MIS and Risk Management practices and comprehensive Internal Controls, will properly prepare banks to address regulatory concerns.

Of course, there will undoubtedly be situations where the decision on whether to downgrade a credit to classified status or place a credit on nonaccrual is a close one. This decision can be complicated in cases where payments on credit have been deferred and are not yet scheduled to begin. As a result, the ability of the borrower to perform on even modified terms has yet to be demonstrated. In these cases, some banks have conservatively opted to place such loans on nonaccrual, in part to prevent having to ultimately reverse income that would continue to be accrued. Typically, these credits will also be downgraded to adversely classified status.

The safest course of action to avoid regulatory criticism would be to take the conservative approach. Rarely, if ever, have regulators criticized a bank for aggressively placing loans on nonaccrual or adversely classifying them. However, a bank can expect criticism if a regulator thinks the bank has been too slow to do so. And regulators will be less aggressive in dealing with a bank if management can demonstrate a willingness and ability to identify problems and put plans in place to deal with them.

Why is all of this of significant importance? In June 2020, the regulators issued “Interagency Examiner Guidance for Assessing Safety and Soundness Considering the Effect of the COVID-19 Pandemic on Financial Institutions.” FinPro recommends that this document be shared with every bank’s senior management and board of directors. Included in this document are some statements regarding CAMELS ratings and how regulators will deal with a bank as follows:

“When assigning the composite and component ratings, examiners will review management’s assessment of risks presented by the pandemic, considering the institution’s size, complexity and risk profile. When assessing management, examiners will consider management’s effectiveness in responding to the changes in the institution’s business markets and whether the institution has addressed these issues in its longer-term business strategy.”

“An examiner’s assessment may result in downgrading component or composite ratings for some institutions. In considering the supervisory response for institutions accorded a lower rating, examiners will give appropriate recognition to the extent to which weaknesses are caused by external economic problems related to the pandemic versus risk management and governance issues.”

“When considering whether to take a formal or informal enforcement action in response to issues related to the pandemic, the agencies will consider whether an institution’s management has appropriately planned for financial resiliency and continuity of operations; implemented prudent policies; and is pursuing realistic resolution of the issues confronting the institution.”

In other words, if banks can demonstrate that they are taking “prudent” actions to deal with borrowers adversely impacted by COVID-19, regulators will take that into consideration in deciding how to respond to asset quality issues that arise as a result.

Pat Rohan is a Managing Director on FinPro’s Regulatory Team. Prior to joining FinPro, Pat had a 32-year career with the FDIC that included six years as the Regional Director (Division of Supervision) for the Boston Region. He earned a juris doctor degree from Loyola University School of Law and is also a graduate of the Stonier Graduate School of Banking. Pat holds a license to practice law in the State of Illinois.

The Bank Exam Prep Center is provided by the Coalition of Bankers Associations to help member banks prepare for upcoming examinations. We ask every bank to complete our anonymous Post Exam Survey after each examination so we can help bankers identify hot topics and exam trends, and regulators resolve inconsistent application of exam practices from agency to agency and region to region. For more information, go to allbankers.org.