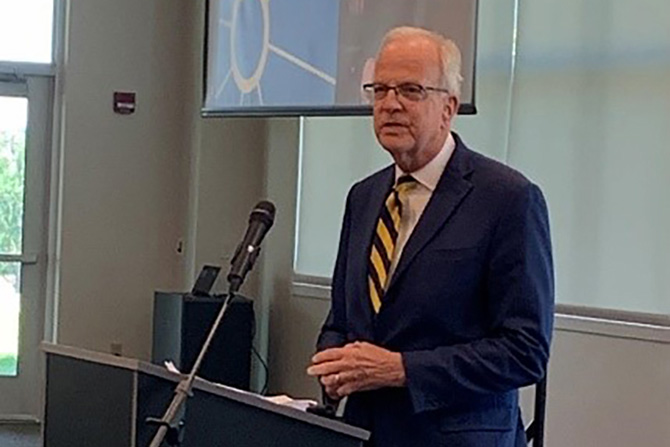

More than 80 Kansas bankers, political and business leaders recently gathered at the SEK Impact Conference Center in Chanute, Kansas, for a regional Financial Town Hall meeting. An update was given from our nation’s capital by U.S. Sen. Jerry Moran, a statehouse report from Kansas Senate Financial Institutions and Insurance Committee Chairman Jeff Longbine and an update on KBA policy priorities and service initiatives supporting the Kansas banking industry. The theme of the Town Hall expressed by KBA Chairman Mark Schifferdecker (Chairman/President/CEO of GNBank, Girard) was Banks Need Community and Communities Need Banks, which stressed the importance of local financial services, relationship banking and leadership provided by bankers in communities across Kansas.

Thank You to Our Generous Co-Host Sponsors!

- Bank of Commerce, Chanute

- CBW Bank, Weir

- Commercial Bank, Parsons

- Community National Bank & Trust, Chanute

- Community State Bank, Coffeyville

- GNBank, N.A., Girard

- Home Savings Bank, Chanute

- The City State Bank, Ft. Scott

- Union State Bank, Ft. Scott