In early 2020, municipal credit concerns were abundant, and tax revenue plunged due to pandemic shutdowns. Since then, average state and local tax revenue has recovered from those declines and grown significantly. Total state and local tax revenue reported by the U.S. Census Bureau was up 13.9% in the first half of 2022 compared to the first half of 2021 and by over 30% compared to the first half of 2019. Federal stimulus funds, coupled with prudent expense management, also helped to improve municipal finances, all of which led to record budget surpluses and large increases in reserves in many cases. However, current high inflation and increasing interest rates could impact municipal finances in several ways.

“First, the cost of supplies and labor is increasing rapidly, in some cases at an even higher rate than the overall inflation rate. Consequently, operating expenses and the cost of capital projects are climbing. Issuers highly reliant on skilled labor for operating activities, such as hospitals and other healthcare-related entities, are vulnerable to a tight labor market. Moody reports that personnel costs account for over 50% of expenses for the hospitals they rate. Some issuers have had to pay over eight times as much in 2022 as they did in 2019 for agency labor. Rural hospitals are particularly susceptible as they generally have difficulty with adequate staffing under normal circumstances.

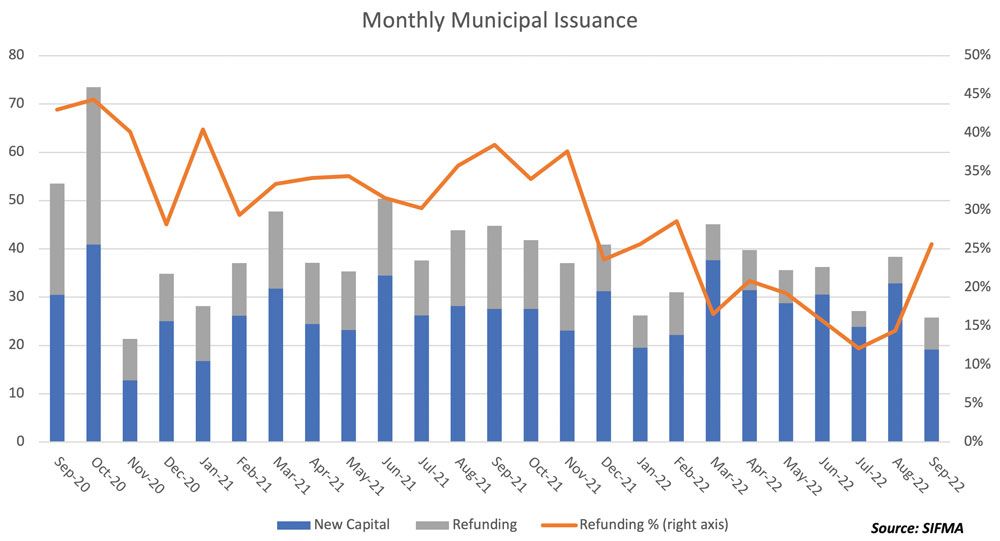

Second, not only are capital projects more expensive than what was estimated for current budgets, but borrowing rates have also been rising. This could result in delayed or canceled projects or lead to higher debt levels and increased interest expense if municipalities choose to go ahead with planned projects. According to SIFMA, new money issuance was on track to be higher in 2022 than in 2021 as of August 2022 data. However, September issuance data shows that both new money and refunding issuance dropped dramatically in September. As rates continue to rise, issuers will have to balance their capital needs with how much interest they can afford to pay.

Third, inflation and higher interest rates can affect pension liabilities and associated expenses. Pension liabilities are computed using assumptions for wage growth and expected inflation. If those assumptions increase or are too low, pension liabilities will increase. Some pension plans have cost of living adjustments based on inflation. Those plans will have an increase in current payouts in addition to an increase in future liability.

Further, pension assets will likely suffer from poor investment returns this year. The trend of movement toward riskier asset classes led to favorable outcomes in 2021 when many plans had record investment gains. However, the opposite may be true in this volatile environment where equities and bonds have declined in value. Moody and S&P both project that all the investment gains pension plans enjoyed last year will be, or already have been, reversed. Assets decreasing while liabilities increase means that unfunded liabilities will rise, and so will required contributions from employers. This may cause budget pressure for some municipalities.

On a more positive note, higher inflation and/or interest rates could increase the discount rate used to determine the present value of pension liabilities. A higher discount rate means a lower estimate of pension liabilities, all else equal. Also, inflation could lead to increases in revenue, particularly for those municipalities that rely heavily on income tax revenue or sales tax revenue derived from the sale of non-discretionary items. Discretionary spending is threatened by a potential recession as well as higher interest rates. Property tax revenue should increase as well since home prices have been increasing significantly. Higher home prices will lead to higher assessed valuations if home values do not depreciate to last year’s level or lower. Whether or not revenues rise by more than expenses will vary from issuer to issuer.

Many issuers have well-positioned reserves right now to help cope with increasing costs and a potential recession in the short term. However, unfunded pension liabilities and growing leverage will continue to be a concern for some local governments. Many healthcare issuers, especially senior living facilities and special development entities, have experienced credit deterioration during the pandemic. They remain particularly vulnerable to further budgetary pressure and credit impairment due to current economic conditions.

The Baker Group’s Credit Criterion Check monitoring system helps to identify issuers susceptible to weakening credit quality. Please contact your Baker representative for more information.

Dana Sparkman, CFA, is Senior Vice President/Municipal Analyst in The Baker Group’s Financial Strategies Group. She manages a municipal credit database covering more than 150,000 municipal bonds, providing clients with specific credit metrics essential to assess municipal credit. Dana earned a bachelor’s degree in finance from the University of Central Oklahoma as well as the Chartered Financial Analyst designation. Contact: 405-415-7223, dana@GoBaker.com.