The Manhattan Hilton Garden Inn was the location for the 2022 Economic & Risk Management Conference on Nov. 2-3. With many CEOs, CFOs and investment bankers on hand, the program provided high-level and timely information for bank development and planning. KBA Chairman Shan Hanes, Heartland Tri-State Bank in Elkhart, welcomed attendees, thanked conference sponsors, and gave special recognitions before introducing the first keynote speaker, small business expert Gene Marks. In his fast-paced and entertaining talk titled, “The Economy, Inflation & Mid-Terms: Tactics, Strategies & Actions to Increase Profitability at Your Bank … and Help Your Customers,” Marks took a deep dive into the factors causing inflation, future cost increases and – most importantly – what leaders at other businesses around the country are doing to navigate their organizations in a higher priced environment. He also provided a review of the latest federal legislation with an emphasis on business matters such as labor, healthcare, taxes, and regulations that will affect our industry moving forward.

“Cryptocurrency and Central Bank Digital Currency” was presented by Brooke Ybarra, SVP, Innovation & Strategy at American Bankers Association. Ybarra provided a framework for understanding different types of digital assets, including traditional cryptocurrency, stablecoin, and central bank digital currency.

She presented a high-level discussion on how banks are engaging in the cryptocurrency ecosystem and reviewed key policy and regulatory developments.

Following lunch, the conference had three options for breakout sessions that included:

- “CECL – A New Risk Management Tool” with Dr. Bruce Morgan, PhD., Professional Bank Consultants, LLC

- “Strategic Plans, Capital Plans & Risk Appetites – How They Fit Together” with Pete Weinstock, Partner, Hunton Andrews Kurth

- “Optimize Your Bank’s Balance Sheet for Flexibility in Uncertain Times” with Glenn Martin, Managing Director, IntraFi Network

In the day’s final session, “Future of Banking with Fewer Employees,” Paul Minter reminded us that the future of banking with fewer employees asks us to manage this changing environment and lead ourselves, teams, and organizations to a new way of working. The labor market in 2022 forced leaders across industries to rethink work, the employee experience, and how we all cope with the local, global, technical, and social changes that impact our workplaces. Navigating the future of work requires navigating ambiguity, preparing ourselves for change, and leading others through the experience of change, all while ensuring we deliver on the most pressing needs and expectations of our businesses. We don’t know all we need to know about the future of work, but in this session, Minter reminded us we have many of the tools we need to successfully lead through this period of change.

Day two of the conference began with Don Musso, President of FinPro, Inc., with his session, “State of the Economy and its Impact on Banks.” The country is literally at a fork in the road. Recent data like unemployment and consumer spending (adjusted for falling gas prices) would indicate a stronger-than-expected economy. Musso explained that rates should rise across the board and that inflation will persist at higher levels. Conversely, the long end of the rate curve, along with negative GDP, would lead us to believe we are already in a recession. Which is it? Our current thinking is that certain regions and industries are in recession while others are not. Much of this is tax policy-driven, so the low-tax states materially outperform the high-tax states. This, as of today, is not a national recession. However, we think it will become a national recession as the Fed raises rates in large increments, which will depress consumer spending. As such, we expect a strong curve inversion in the near term.

Musso’s outlook is that this will not be good for community banks as our deposit rates will climb while our loan rates will remain lower than they should be. The overall compressing net interest margin will materially negatively impact earnings.

Steve Wyett, BOK Financial, presented a talk on “Adventures in Economic, Monetary, and Fiscal Policy.” “The Fed has got more work to do,” said Wyett. “Inflation pressures take longer to come out of the system.” The solid rebound in the gross domestic product, or GDP, in the third quarter following two straight quarters of economic contraction may also quiet some (but not all) recession worriers. That could also prompt the Fed to continue its aggressive rate hiking stance, even if such a policy risks causing a recession down the road. The worry is that the Fed may be choosing to look more at current economic data and isn’t thinking enough about the lag effect of its existing rate hikes. Inflation in the U.S. economy may not have peaked yet, but there is a growing sense we’re pretty darn close to that.

The conference closed with a highly energetic session, “Lead with Everyday EXCELLENCE” by Dustin James. We ALL can control our Emotions, Education, Experiences, and Energy, all valuable tools for business and life. To reach everyday excellence, we must focus on the internal factors we can utilize to grow and build our businesses, relationships, and life. We easily get distracted by outside factors that move us away from motivation, goals, and our game plan. This interactive closing session provided attendees with valuable tools to create an ACTION PLAN, creating a path to extreme success.

Mark your calendars for next year’s conference: Nov. 8-9, 2023 in Manhattan.

Thank you to this year’s sponsors!

Left to right: John Kilroy, UMB Bank NA in Kansas City, Natalie Regan, Country Club Bank in Prairie Village, and Francis Scheuerman, UMB Bank in Kansas City network during a refreshment break.

Dustin James closed the conference with his energizing presentation, “Lead with Everyday EXCELLENCE.”

Shan Hanes, KBA Chairman from Heartland Tri-State Bank in Elkhart, welcomed attendees.

Left to right: Hetal Desai, Equity Bank in Wichita, and Tim Kemp, Office of the State Bank Commissioner in Topeka, catch up during the Conference.

Left to right: Tammy Placzek, INTACT Financial Services from Minneapolis, Minnesota, and KBA’s Alex Greig, President of KBA Insurance, Inc.

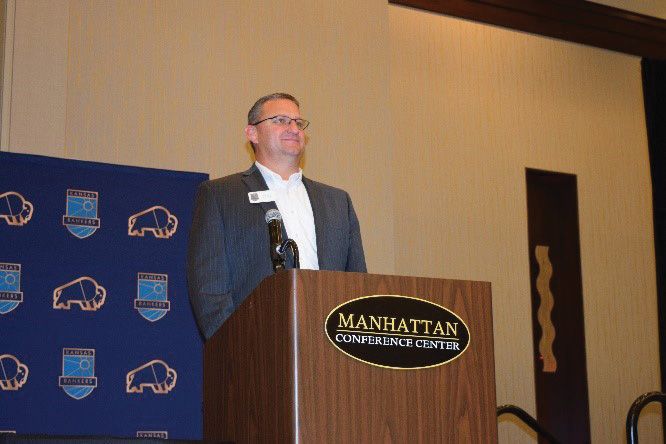

KBA’s President & CEO Doug Wareham speaks to attendees about KBA’s current legislative and regulatory initiatives.

Left to right: Matt Lephardt and Patrick Smith from BOK Financial Capital Markets in Overland Park, and Brady Chianciola, Profit Resources Inc., in Monroe, Georgia.

Left to right: Jack Galle, Legacy Bank in Wichita, and Quinton Smith, INTRUST Bank, N.A. in Wichita.

Left to right: KBA Chairman Shan Hanes, Heartland Tri-State Bank in Elkhart, and presenter Gene Marks, Marks Group.