The short answer to that question is a resounding “Yes!” The economy is reopening, the vaccine is widely available, and face coverings and social distancing mandates are being lifted. Regarding the coronavirus pandemic, these are all good things. However, regarding a bank’s loan portfolio, there may still be some lingering risks of which bankers will need to stay abreast.

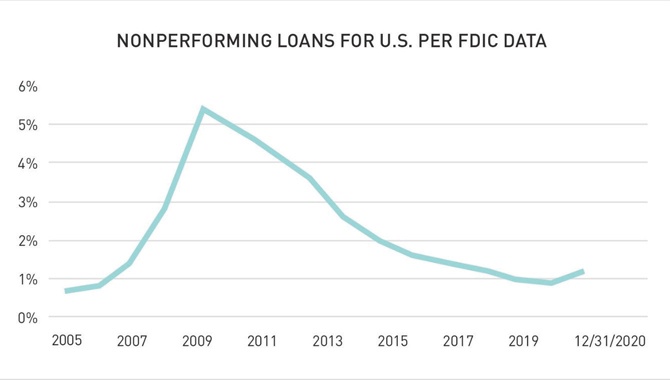

If you rewind to this time last year, bankers really did not have an idea of how the pandemic would affect overall credit quality. The below graph shows that while nonperforming loans have ticked up since year-end 2019, overall credit quality has not suff ered close to the level we all thought it might and is still much better than in the last credit crisis, although not quite as good as shown when considering the number of borrowers still in deferral and not reported as past due.

We are not out of the woods when it comes to the effects of the pandemic on a credit portfolio. Here are some things to think about in a few segments that still have looming questions:

Office & Retail Commercial Real Estate – What will the long-term effects of the pandemic be? Will office workers return to the office? They may in the short term, but as leases roll off, will companies renew leases on all their office space, or will they reduce it and allow workers to work remotely to save occupancy costs more permanently? Brick-and-mortar retail had been on a slow decline prior to the pandemic. Will the decline accelerate, or are people anxious to get back to an actual shopping experience?

Senior Living Facilities – Given the effects of the pandemic on senior living facilities, will people transition to these facilities as they have in the past, or will technology and the improvements in home healthcare delay those transitions?

Hospitality Including Hotels, Event Spaces, Movie Theaters, etc. – These companies were hit especially hard during the initial stages of the pandemic and were forced to rely on government assistance. How will they perform without the assistance? Local employment also will have an effect on these companies. Are they able to find workers to reopen? Will the workers be more expensive? Are there remaining restrictions in place?

Apartments – There may be some unidentified risk in these properties due to government stimulus payments and moratoriums on evictions. As with hospitality companies, the local employment picture will affect these properties.

Here are some things to consider to help prevent some unnecessary surprises:

1. Pandemic-Related Loan Modifications – While there is still some uncertainty, pandemic-related loan modifications should now be the exception and not the rule. Make sure you are closely evaluating any continuing modifications and not just delaying the recognition of a bad loan. Analyze the business’s fundamentals, and be realistic about the business’s prospects for recovery.

2. Be Realistic About Appraisals – In your evaluations of appraisals, make sure you are considering whether the appraisal was pre-COVID-19 or more recent, as well as what the pandemic’s short- and long-term effects are on the property’s operating income. Have conversations with your appraisers to discuss local vacancy trends, cap rate trends, and other aspects that might be affecting real estate markets. Appraisers not only have local market knowledge but also can help you understand national trends that might affect your borrowers.

3. Analyze Concentrations – A concentration in any industry will act like one very large loan. Make sure to realistically stress test the concentration relative to bank capital for both potential movement to classified risk grades and potential loss given default.

4. Identify Problem Loans Quickly – As we continue to recover from the pandemic, the most important thing you can do is identify problem loans quickly. Borrowers have received assistance from Paycheck Protection Program loans, Economic Injury Disaster Loans, the U.S. Small Business Administration making loan payments, bank deferrals and modifications, economic stimulus checks, and other vehicles. Be realistic about a borrower’s prospects without all the assistance. Do not wait for loans to be past due, as delinquencies are a lagging indicator of credit quality. You need leading indicators (such as current 2021 results compared to projections) because early problem identification often leads to improved results.

As we continue to evolve from the pandemic that has gripped us the past 15 months, it is more important than ever to maintain diligence over your loan portfolio—the biggest asset on your balance sheet—and not become lax due to the positive reports in the press. The benefit may be improved loan performance resulting in lower loan losses.

This article is for general information purposes only and is not to be considered as legal advice. This information was written by qualified, experienced BKD professionals, but applying this information to your particular situation requires careful consideration of your specific facts and circumstances. Consult your BKD advisor or legal counsel before acting on any matter covered in this update.

Mark Weitekamp is a member of BKD’s National Loan Review Service division. He has spent the last 25 years working with large super regional banks as well as small commercial banks with credit underwriting, portfolio management, cash flow analysis and loan documentation.