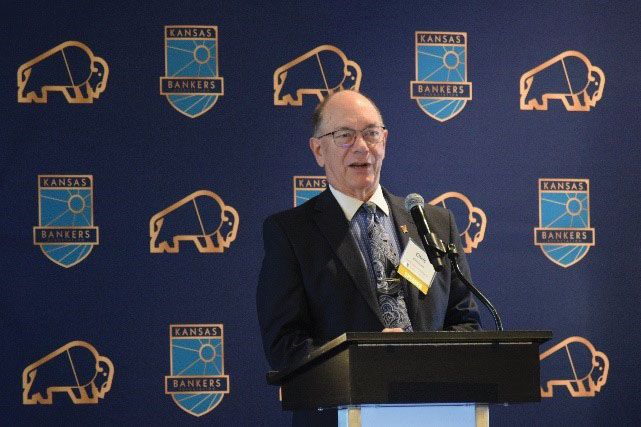

Mike Ewy, KBA Past Chairman and President and CEO of Community State Bank in Coffeyville, kicked off day one of the 2022 Annual Conference for Lenders, which was held Oct. 6-7 at the Marriott Hotel in Wichita.

The first speaker of the Conference was David Ruffin, IntelliCredit Company, with his presentation, “Navigating COVID-19 and the Rough Credit Cycle in its Aftermath.” Ruffin shared how a black swan named COVID-19 has ushered in a swift and dramatic end to the prolonged and recently benign credit cycle. Despite economic stimuli and regulatory relief, attendees can expect the credit degradation prompted by this crisis to be problematic and extensive.

After a quick break and visits with exhibitors, attendees were introduced to the next speaker, Dr. Roger Tutterow, Kennesaw State University, with his presentation, “Where to Go from Here: Navigating in a Post-COVID World.” This session provided a timely overview of global, national and regional economies, including recent developments in the effect of COVID-19 on the retail sector and real estate, the cause and effects of the recent changes in energy prices, the structure and effect of the recent changes in energy prices, the structure and effect of recent fiscal stimulus and the linkages between trade policy and currency valuation. Emphasis was placed on recent volatility in the short-term funding market, the return to the zero-rate policy, the inflation outlook and implications for fixed income performance, etc.

Following lunch, attendees spent a good majority of the afternoon attending breakout sessions which included topics such as “Lending Regulatory Update,” “Hemp, CBD & Marijuana Banking,” and “We Don’t Know What We Don’t Know” Concerns: Addressing Some Common Issues and Differences in Approach from Lender and Lawyer.”

Wrapping up the first day, the “Minority Business Lending: An Opportunity that Increases Profitability Panel Discussion” was kicked off by moderator Doug Wareham, KBA President and CEO. Panelists included: Jim Echols, Renaissance Management & Training Solutions, LLP; Mark Schepers, Community Bank, Liberal; Teresa Randle, The Plains State Bank, Liberal; and Ernesto Hodison, Capitol Federal Savings Bank, Lawrence.

Attendees ended the day with refreshments and conversations with the Exhibitors.

Colby May, Lending Chairman from Equity Bank in Wichita, kicked off day two and introduced the first speaker, Chris Kuehl from Armada Corporate Intelligence. Chris Kuehl’s presentation was “Navigating the Post-Pandemic Economy: New Worries with the Relief.” Attendees were able to see the new challenges they may face after having emerged from the pandemic and what they can now expect in the next year.

Next was Andrew McCrea, American Countryside, with “Kansas Banks’ Role in Creating Total Town Makeovers.” Ag and rural economies sit at a unique crossroads. Farm income has risen with increased commodity prices and 2020 government program payments. Ag land and machinery prices are growing at a fast pace. Yet, the story for non-ag businesses that support farmers in rural communities may not be the same. Smaller towns supporting agriculture may struggle to keep small businesses open, maintain quality schools and provide a place for younger people to work and establish homes and families. Kansas banks play an important role in what happens next.

The conference was wrapped up with the final speaker, Alex Weber, American Ninja Warrior, with his presentation, “The Positivity Edge: The Key to Record-Breaking Achievement in Any Season.” How do you tap into the ultimate creativity, confidence, and resourcefulness when it matters most, and the stakes are high? You need a reliable way to avoid living and working in unproductive energy, where stress is high, solutions seem limited, mistakes are repeated, and perceived challenges only grow stronger. Instead, you need to activate The Positive Energy Edge.

Thank you to our Conference Sponsors and to all attendees able to make it!

David Ruffin, Intellicredit Company, was the first speaker at the 2022 Annual Conference for Lenders in Wichita with his presentation, “Navigating COVID-19 & the Rough Credit in its Aftermath.”

Mike Ewy, Past KBA Chairman and President & CEO of Community State Bank in Coffeyville, welcomed all attendees to the conference on day one.

Dr. Roger Tutterow from Kennesaw State University presented “Where to Go from Here: Navigating in a Post-COVID World.”

KBA’s Terri Thomas, JD, EVP & COO, Legal Department/KBCS Director, introduced Melissa Nelson-Baldwin from South Bend Industrial Hemp during the breakout sessions.

Melissa Nelson-Baldwin from South Bend Industrial Hemp presented the latest information about the ins and outs of the industrial hemp industry.

(Left to Right) The “Minority Business Lending: An Opportunity that Increases Profitability Panel Discussion” included Doug Wareham, KBA President & CEO; Jim Echols, Renaissance Management & Training Solutions, LLC; Ernesto Hodison, Capitol Federal Savings Bank, Lawrence; Teresa Randle, The Plains State Bank, Liberal; and Mark Schepers, Community Bank, Liberal.

(Left to Right) Mike Ewy, Past KBA Chairman and President & CEO of Community State Bank in Coffeyville; Greg Schreiner, KANZA Bank, Kingman; and Kent Owens, SVP of KBA Insurance, Inc., enjoyed networking at the conference.

Colby May, Lending Chairman from Equity Bank in Wichita, welcomes attendees to day two of the conference.

Chris Kuehl, Armada Corporate Intelligence, presented “Navigating the Post-Pandemic Economy: New Worries with the Relief.”

Speaker Andrew McCrea with American Countryside, presented “Kansas Banks Role in Creating Total Town Makeovers.”

Alex Weber, American Ninja Warrior, closed out the conference with his energized presentation, “The Positivity Edge: The Key to Record-Breaking Achievement in Any Season.”