By Leticia Saiid, CoNetrix

To have an effective Business Continuity Plan (BCP), recovery plans must be based on a Business Impact Analysis (BIA). According to the FFIEC’s Business Continuity Management booklet, BIA is “the process of identifying the potential impact of disruptive events to an entity’s functions and processes.” There are a lot of elements to capital BIA, but for the purpose of this article we are going to focus on the conceptual lower-case business impact analysis. This analysis will help you make informed decisions about when certain processes can be restored and help you determine appropriate Recovery Time Objectives (RTO).

Prepare the Definitions

The first step in simplifying a BIA is to define ratings, categories, and labels of any kind. Definitions are foundational to an effective analysis process.

Criticality Levels

Criticality Levels are necessary for defining which processes require more immediate attention than others. Consider creating a set of levels such as: Critical, Urgent, Important, Normal, and Nonessential. If you work for a smaller institution, you may find you need fewer level options.

The definition of each criticality level is its corresponding Maximum Tolerable Downtime (MTD). This is the amount of time your business can tolerate without the process. For Critical processes, you may only tolerate minutes, but for Nonessential processes you might tolerate weeks.

Business Impact Categories

When considering downtime of a business process, consider the ramifications this downtime may have on your organization. The kind of impacts that concern you will determine your categories. At a minimum, you should consider the Compliance, Financial, Operational, and Reputational impacts to your organization, should a process be unavailable.

For each category, provide clear definitions for each rating. For example, consider the following impact level definitions for the Compliance category:

- Insignificant: Negligible compliance, contractual, regulatory, or legal concerns.

- Low: Potential for compliance, contractual, regulatory, or legal issues with minor implications.

- Medium: Confirmed compliance, contractual, regulatory, or legal issues with moderate implications.

- High: Major penalties and/or costs related to compliance, contractual, regulatory, or legal issues.

- Extreme: Extreme penalties related to compliance, contractual, regulatory, or legal issues (e.g., jail time for employees, closing of the institution, etc.).

Analyze Impact

Make a list of your business processes. Business processes are a combination of the people, resources, and procedures that achieve a goal, such as Accounting, Information Technology, Lending Operations, Cash Management, and Regulatory Reporting.

Review one process at a time. Gather a group of people who deeply know and understand the process and how the lack of the process could impact the institution in different ways over different periods of time. Identifying the impact level for each category at each timeframe allows you to determine the MTD for this process.

Example Analysis

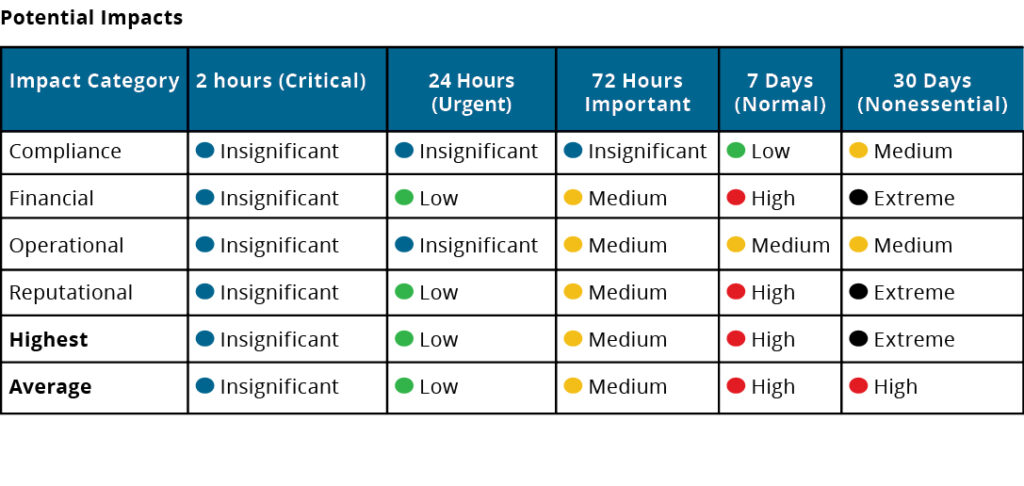

Let’s look at an example business impact analysis with the Mobile Deposit Capture process and the Reputational impact category. If a disruption to this process occurred, what impact would this have on the organization? Don’t spend too much time thinking about why the process is unavailable. Knowing why a process is unavailable is irrelevant to how long your organization can tolerate going without it before the missing piece begins to affect the organization’s mission, customer experiences, other business functions or compliance requirements.

After one hour, the institution may have a few unhappy customers, but the impact would overall be Insignificant. Even after one day, the impact might still be Low. If the process was down for three days, clients may really start to notice and could be upset (Medium). After one week, the organization would likely have to do a lot of work to regain trust (High). If the process was unavailable for 60 days, the impact might be Extreme, as clients could be lost and damage our reputation with the community. See the image below for an example of what the ratings could look like.

When this assessment is performed for each category, the level of tolerance can be identified before a disruption becomes too detrimental for the business. That is the process’ maximum tolerable downtime, and thus, criticality level. In this example, perhaps the impact is generally low prior to three days, so this process is set as Important. This means, in the event of a widespread business disruption, other higher priority processes will be given attention before this one, until the three-day mark is reached.

Override for Dependent Processes

Don’t forget about process dependencies. This could completely override the criticality level you determine through the BIA process. If there is another process with a shorter MTD which depends on this one to function, you must shorten the MTD of this process to have it ready to support the dependent one. Another option would be to reconsider the relationship between the two processes or reconsider if the other process has an accurate MTD.

Leticia Saiid has been in the information security industry and providing public speaking for eight years. Leticia has a passion for clear and concise communication. After earning a B.A. and an M.A. in Mathematics, Leticia joined CoNetrix, where she served as the Tandem Software Support Manager for several years. She built and directed Tandem’s first team of support specialists. Leticia now serves as chief of staff, where she focuses on corporate strategy, employee development and training. Leticia is Security+ certified, has published various security blog posts and articles, and has presented multiple conference sessions over information security topics.

This story appears in Issue 4 2020 of The Kansas Banker Magazine.