By Kara Cramer, BKD

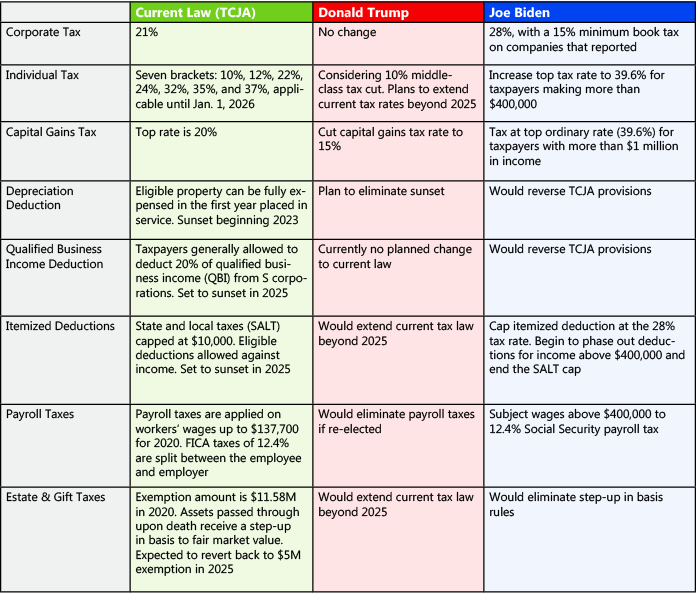

In an election year, taxes always seem to come to the forefront of each candidate’s campaign — and this year appears to be no exception. This article will examine each candidate’s tax plan and offer some potential tax planning strategies a bank may consider implementing should former Vice President Joe Biden win the presidency and the Democrats win the majority in the Senate. In 2017, we saw the first overhaul of the tax code in more than three decades, which came in the form of the Tax Cuts and Jobs Act (TCJA). The TCJA implemented a permanent reduction of corporate tax rates from graduated brackets with a maximum of 35% to a flat rate of 21%. The law retained the old individual bracket structure of seven brackets; however, in most cases, it offered a reduction in tax rates. The highest individual tax rate was decreased from 39.6% to 37%. Alongside the reduced tax rate, bank shareholders generally benefited from the qualified business income deduction of 20%. Unlike the corporate tax rates, these individual changes are temporary and scheduled to sunset in 2025. Below is a summary of the current tax law and each candidate’s proposed tax plan:

How would these changes affect your bank and its shareholders? If there’s an increase to tax rates, there’s potential to implement strategies that could result in permanent tax savings. This can be achieved by deferring deductions into tax years with higher tax rates or accelerating income into tax years with lower tax rates. Some ways to accomplish this would include changing your accounting methods, electing out of bonus depreciation, eliminating prepaid expenses, deferring expenses, and waiting to implement a cost segregation study until an increase in tax rates occurs. Here’s an example to illustrate these potential permanent tax savings. Currently, you own an S Corp bank that acquired bank equipment worth $100,000 in 2020. Your shareholders are all eligible to take the QBI deduction of 20%, as described above. This deduction makes your effective tax rate 29.6% in 2020. Should the tax rates increase and the QBI deduction be repealed under Biden’s plan, your effective tax rate would be 39.6%. You could elect to take bonus depreciation to take the full $100,000 in 2020 or elect out of bonus depreciation and only deduct $20,000 in 2020. Should tax rates increase in 2021, you would save 10% or $8,000 in permanent tax savings and increase bank capital by electing out of bonus depreciation in 2020.

While there’s no way to predict the election’s outcome, it would appear some substantial changes to the tax law could be on the horizon. We encourage taxpayers to begin discussions with their tax advisors to take advantage of any potential changes.

Kara Cramer, BKD

This article is for general information purposes only and is not to be

considered as legal advice.

This information was written by qualified, experienced BKD

professionals, but applying this information to your particular

situation requires careful consideration of your specific facts and

circumstances. Consult your BKD advisor or legal counsel before

acting on any matter covered in this update.

This story appears in Issue 5 2020 of The Kansas Banker Magazine.